Planning for retirement often requires balancing growth opportunity with long term stability. Many investors begin their journey focusing on traditional assets like stocks, bonds, and mutual funds. These options can certainly support long term wealth building, but they can also expose a retirement account to market volatility and inflation. Over time, this uncertainty has led many people to explore alternative assets that offer more resilience during unpredictable economic cycles. One option that consistently attracts attention is physical gold through a self directed Gold IRA.

Gold has been used as a store of value for centuries. It is trusted across cultures, economies, and generations. Its historical reputation as a safe haven gives investors an avenue for protection that traditional paper assets cannot always provide. Moving part of an IRA into gold is not about abandoning market growth. Instead, it is about creating a more balanced, durable foundation for the future. Understanding the advantages of such a move is essential for anyone considering whether this strategy fits their broader retirement plans.

This article explores the top benefits of transferring a portion of your IRA into gold, how it supports long term financial health, and why so many retirement planners see it as a powerful tool for stability and diversification.

1. Diversification That Strengthens Your Portfolio

Diversification is a familiar term for most investors, but its importance cannot be overstated. When all your retirement assets move in the same direction, your risk increases significantly. Stocks, for example, are tied closely to economic performance, company earnings, interest rates, and global events. When markets move sharply, retirement accounts heavily invested in equities feel the impact immediately.

Gold operates differently. Its value does not rely on corporate profits or central bank policies. Instead, gold historically rises or holds steady when markets become unstable. Adding gold to your IRA provides a counterbalance that helps reduce overall volatility. You are not relying on a single asset type to support your financial future. Instead, you are building a blended strategy that can weather a variety of economic conditions.

For many long term investors, this kind of diversification is essential. It ensures that a market downturn does not unravel years of savings and careful planning. A Gold IRA allows you to hold physical bullion within a tax advantaged account, which means your diversification strategy fits neatly into your broader retirement structure.

2. Protection Against Inflation

Inflation erodes the purchasing power of your money over time. Even mild inflation impacts your lifestyle in retirement because goods and services gradually become more expensive. Traditional savings accounts or low yield investments often fail to keep pace with rising costs. When inflation accelerates, the problem becomes much more noticeable.

Gold tends to perform well during inflationary periods. Because it is a tangible asset with inherent value, gold is not weakened by currency fluctuations or monetary policy decisions. Historically, when the dollar weakens, gold prices often rise. This makes gold an effective hedge for protecting your retirement assets against long term inflation.

Including gold in your IRA gives you a buffer that helps preserve your purchasing power. It acts as an insurance policy so your savings retain their strength even when economic conditions shift.

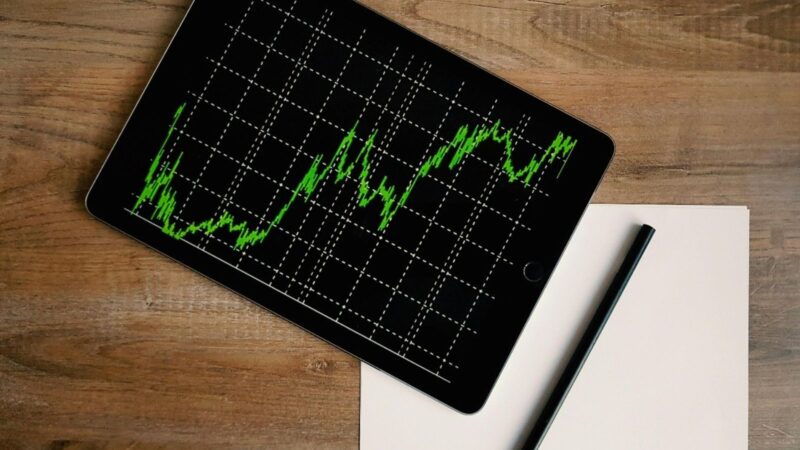

3. Stability During Market Volatility

Market volatility can be unsettling for any investor, especially for those approaching retirement who do not have decades to recover from major downturns. Events like geopolitical conflict, natural disasters, economic recessions, or sudden financial crises can create sharp market drops that dramatically affect traditional IRAs.

Gold stands out because it behaves predictably during periods of uncertainty. Investors often flock to gold when confidence in other assets declines. This demand helps push gold prices upward, giving your Gold IRA the potential to gain value when other assets are declining.

By moving part of your retirement savings into physical gold, you are creating a cushion that helps stabilize your portfolio during turbulent financial cycles. This stability is especially valuable for retirees who want consistency rather than aggressive risk.

In learning how to make this transition effectively, many investors reference an ira to gold guide to help clarify the steps and considerations involved.

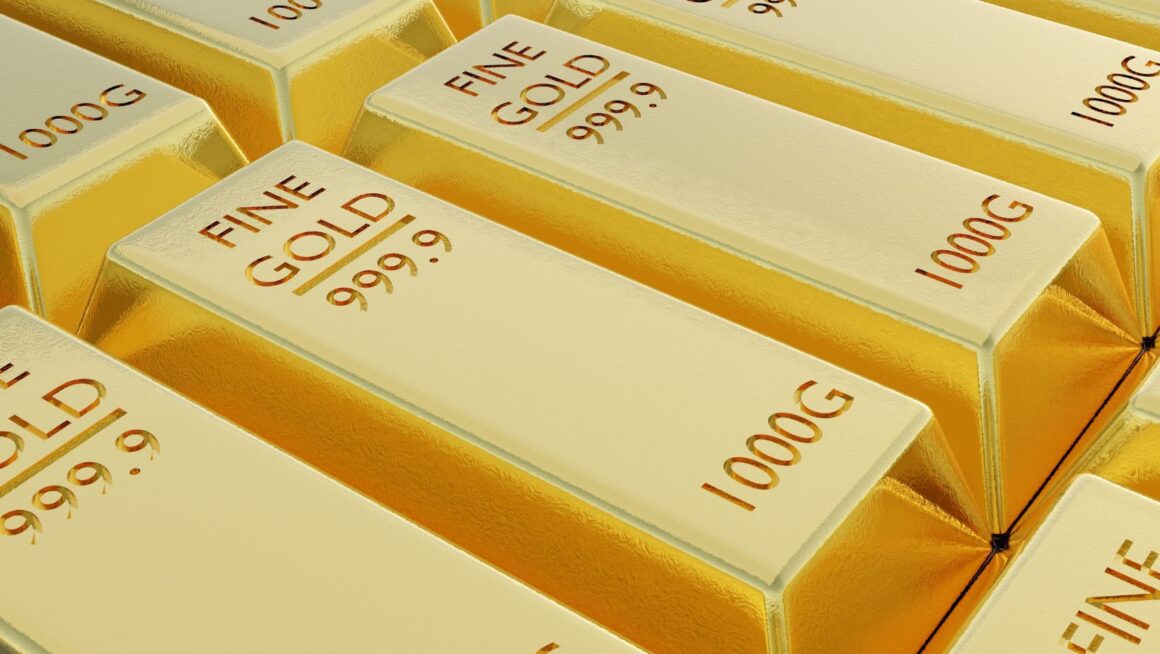

4. Long Term Preservation of Wealth

Gold is unique among assets because it never loses its fundamental value. It does not degrade or rely on external systems to retain worth. It has remained valuable through wars, political changes, economic collapses, and technological revolutions.

Over long time periods, gold has shown an impressive ability to maintain value compared to paper assets. Currencies have been replaced, stock markets have risen and fallen, and entire industries have transformed, yet gold has consistently served as a reliable store of wealth.

This is one of the strongest reasons investors choose to move a portion of their IRA into gold. They want assurance that part of their retirement savings will maintain value over decades. Gold’s stability provides that reassurance.

5. Protection From Overreliance on the Dollar

Most Americans hold the majority of their wealth in assets denominated in U.S. dollars. While this may seem natural, it creates a form of concentration risk. If the dollar weakens due to inflation, monetary policy, or global economic shifts, your retirement assets can lose purchasing power quickly.

Gold is independent of the dollar. When the dollar declines, gold prices tend to rise. This inverse relationship helps protect the value of your IRA. Holding gold reduces exposure to currency risk and strengthens your overall financial resilience.

For investors who are concerned about long term fiscal policy or national debt, gold offers a meaningful safeguard. It allows you to hold an asset that rises during periods of dollar weakness, thereby securing a more balanced and protected retirement portfolio.

6. Increased Control Through a Self Directed IRA

Moving gold into an IRA typically involves setting up a self directed IRA, which gives you more control over your investment choices. Unlike standard retirement accounts that restrict you to stocks, bonds, and mutual funds, a self directed IRA allows for a wider range of assets including physical gold.

This flexibility is often appealing to investors who value control. Rather than being limited to market based instruments, you can build a portfolio that reflects your risk tolerance, financial goals, and personal investment philosophy.

A self-directed IRA also lets you choose the type of gold you hold, such as bullion bars or IRS approved coins, and select the custodian and storage method that best fit your preferences. This level of customization is not available in most traditional IRA structures.

7. Strong Demand and Limited Supply

Gold is a finite resource. Unlike fiat currency, it cannot simply be printed or created. This limited supply supports long term value growth because demand for gold remains consistently strong.

Central banks around the world hold gold as part of their reserves. Investors frequently turn to gold during uncertain times. Industrial and technological uses also contribute to steady demand. These factors work together to support gold’s price and long term desirability.

Adding a scarce asset to your retirement strategy can be a powerful move. While no investment is completely without risk, gold’s supply and demand dynamics offer strong potential for enduring value.

8. Estate Planning Advantages

For those thinking beyond their own retirement years, holding physical gold in an IRA can offer estate planning advantages. Gold is a straightforward asset to pass down to heirs. It carries universal value and does not require specialized knowledge to understand.

Additionally, the structure of an IRA allows you to designate beneficiaries directly. This can simplify the transfer process and ensure your assets move smoothly to the next generation. For families seeking clarity and stability in their long term financial planning, gold can play an important role.

Final Thoughts

Moving part of your IRA into gold is not a short term strategy. It is a long term approach that strengthens your retirement foundation by adding diversification, inflation protection, stability, and wealth preservation. Gold has a unique ability to hold value through changing economic cycles, making it a powerful complement to traditional investments.

Investors who choose to include gold in their retirement planning are not relying on fear or speculation. They are making a thoughtful decision to protect their future by adding an asset with centuries of proven reliability. As you evaluate your own retirement goals, considering gold as part of your IRA may offer the balance, security, and confidence you need for the decades ahead.