Money and sport have always flirted with each other. From the village pitch collector who “borrows” a little from ticket sales, to global broadcasting giants, the game has long attracted people with calculators and big dreams. Today, that relationship has moved into a new phase: sports startups – small, fast, and hungry – chasing investors who move almost as quickly as wingers on a counter-attack.

Founders pitch ideas in co-working spaces and coffee shops. Investors show up in shirts and sneakers, spreadsheets in hand. The question on both sides is simple: can this idea capture fans’ attention and turn it into sustainable revenue?

Why Investors Are Suddenly in Love With Sports

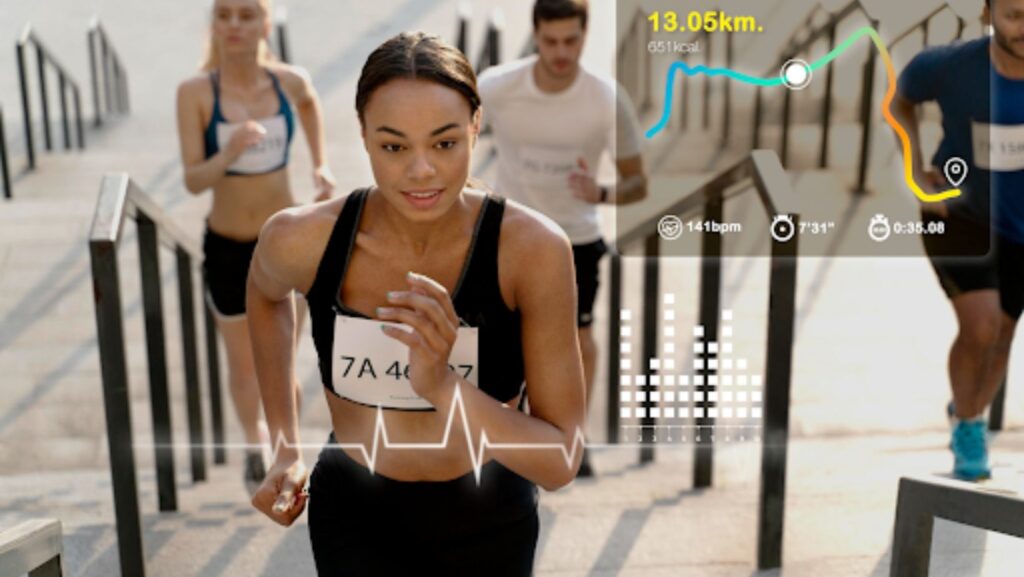

Modern sport is no longer just 90 minutes or four quarters. It’s a continuous stream of content, data, and micro-moments. Fans follow players on social media, track stats during games, and argue about tactics in group chats. Each of those touchpoints is a potential product: a new app, an analytics platform, a fan-engagement game.

Investors see three key things:

- Huge, loyal audiences that return week after week.

- High emotional engagement – fans care deeply, which can translate into strong retention.

- Room for digital transformation, from ticketing to performance tracking.

When you mix those ingredients, you get a market where a small, focused startup can grow fast if it hits the right nerve.

What Kinds of Sports Startups Are Getting Funded?

The ecosystem now includes more than just clubs and broadcasters. Some of the hottest areas are:

- Performance analytics tools for coaches and players.

- Fan-engagement apps that gamify watching live matches.

- Online coaching and training platforms for young athletes.

- Ticketing and venue-management solutions for stadiums and arenas.

- Regulated gaming and betting platforms that turn fan knowledge into structured entertainment.

Each segment speaks to a different part of the sports economy – from the locker room to the living room.

Betting Platforms as Part of the Investment Landscape

Sports betting has become one of the most visible commercial layers around live events, and regulated platforms are a natural magnet for investors. They combine high volumes of small transactions, real-time data streams, and a constant flow of sporting events. Done well, that means recurring revenue and long-term partnerships with media and teams.

In some markets, a regulated ethio bet site is not just a place where users place slips; it’s a full digital ecosystem for sports betting, with live odds, promotions, and personalised offers under one hood. Investors closely examine how these platforms manage risk, protect users, and comply with local regulations. No one wants a shiny app that crashes the first time a big derby kicks off – or regulators come knocking.

How Investors Judge Potential Returns

Before signing a cheque, serious investors ask hard questions:

- What is the customer acquisition cost, and how does it compare to lifetime value?

- How strong is the technology stack – can it handle traffic spikes when a big game starts?

- Is the business model diversified (subscriptions, advertising, revenue share, fees)?

- How robust is the regulatory position, especially for anything touching betting or payments?

Founders who can speak confidently about churn rates, retention, and compliance usually stand out. Those who only say, “Sports fans will love it, trust me,” rarely make it past the first meeting.

Mobile-First: Where Apps, Data Bundles and Odds Collide

Across the continent, the real stadium is in people’s hands. The smartphone has become the ticket office, TV screen, prediction notebook and betting slip all in one. Investors know this, which is why many sports startups pitch mobile-first products.

Founders building second-screen tools for live games understand that users already juggle messaging apps, highlight clips, stats pages and sports betting platforms on a single device. In that context, some fans go straight from a social-media highlight to download melbet ethiopia app, turning a few taps into live sports betting slips and multi-markets. Startups that integrate smoothly into that mobile rhythm – fast logins, light data consumption, clean interfaces – look especially attractive to investors who care about scale.

Balancing Profit, Integrity and Fan Trust

Every time money gets close to sport, questions about integrity follow. Fixing scandals, irresponsible promotion of gambling, shady sponsorship deals – investors have seen this movie before. The smart ones now pay attention to governance and ethics from day one.

For startups, that means:

- Clear rules on how data is collected and used.

- Transparent partnerships with teams and leagues.

- Responsible-gaming tools and messaging where betting is involved.

- Honest communication with users about risks and rewards.

Fans can forgive the occasional bug; they don’t forgive feeling cheated. Investors know that trust is the most valuable asset a sports business can hold – more useful than any logo on a jersey.

In the end, sports startups that win investment usually have three things: a real problem to solve, a product that respects both fans and regulators, and a team that understands the game beyond the numbers. When that combination clicks, even the toughest investor nods, closes the laptop, and says the words every founder wants to hear: “Let’s talk terms.”