The financial world runs on trust. Whether it’s a startup pitching a new investment platform or a legacy bank rolling out an app redesign, credibility is currency.

Yet, as finance moves deeper into digital ecosystems, trust isn’t just built through reputation, it’s designed into every interaction.

In 2025, fintech’s biggest differentiator isn’t innovation; it’s interpretation.

Users must be able to understand, navigate, and believe in what they see. That’s where UX, accessibility, and AI readiness converge. Not as aesthetic preferences, but as structural foundations for financial confidence.

The Trust Gap in Fintech

The financial industry’s digital transformation has democratized access but also magnified confusion.

Complex dashboards, opaque data visualizations, and inconsistent interfaces have left many users skeptical of their own comprehension, and by extension, the brand itself.

A 2024 Deloitte study found that 63% of users equate visual simplicity with trustworthiness in financial apps. Meanwhile, apps that use clear language and visual consistency have measurably higher retention and lower churn.

The takeaway is simple: good UX is no longer a nice-to-have, it’s a compliance function.

When people can’t understand what’s happening to their money, they don’t engage, they exit.

Designing for Cognitive Trust

Trust online starts with cognitive comfort and the sense that a product “makes sense.”

Clear hierarchy, legible typography, and intuitive flows signal credibility as much as security certificates do. Every micro-interaction, from a hover state to a data refresh, communicates reliability.

In fintech, that’s critical. Interfaces don’t just display numbers, they also imply meaning. A fluctuating chart, an unlabelled button, or a color shift can change how users perceive their stability or risk.

Designers need to think in terms of interpretive UX: not just making data visible, but making it meaningful.

That requires:

- Predictability: Consistent patterns across screens reduce cognitive load.

- Transparency: Plain-language explanations of fees, transactions, and outcomes.

- Feedback loops: Real-time confirmation of user actions builds confidence.

- Emotional neutrality: Visual tone should communicate control, not excitement or anxiety.

When people feel that their financial tools explain themselves, they’re more likely to explore and more likely to stay.

Accessibility as an Indicator of Maturity

Accessibility in finance isn’t just a moral or regulatory obligation, but a market opportunity.

Globally, over one billion people live with disabilities that affect digital navigation. In an industry predicated on universal access, failing to meet accessibility standards means excluding massive audiences.

Features like voice assistance, proper semantic markup, and color-contrast compliance aren’t fringe enhancements. They’re trust markers. They show users that a company anticipates diverse needs and respects their autonomy.

The same features that make an app accessible also make it clearer for everyone.

Readable language, clear focus states, and keyboard navigation all reduce friction. Accessibility is, at its core, usability, and usability is where confidence begins.

Designing for Machine Trust: AI Readiness

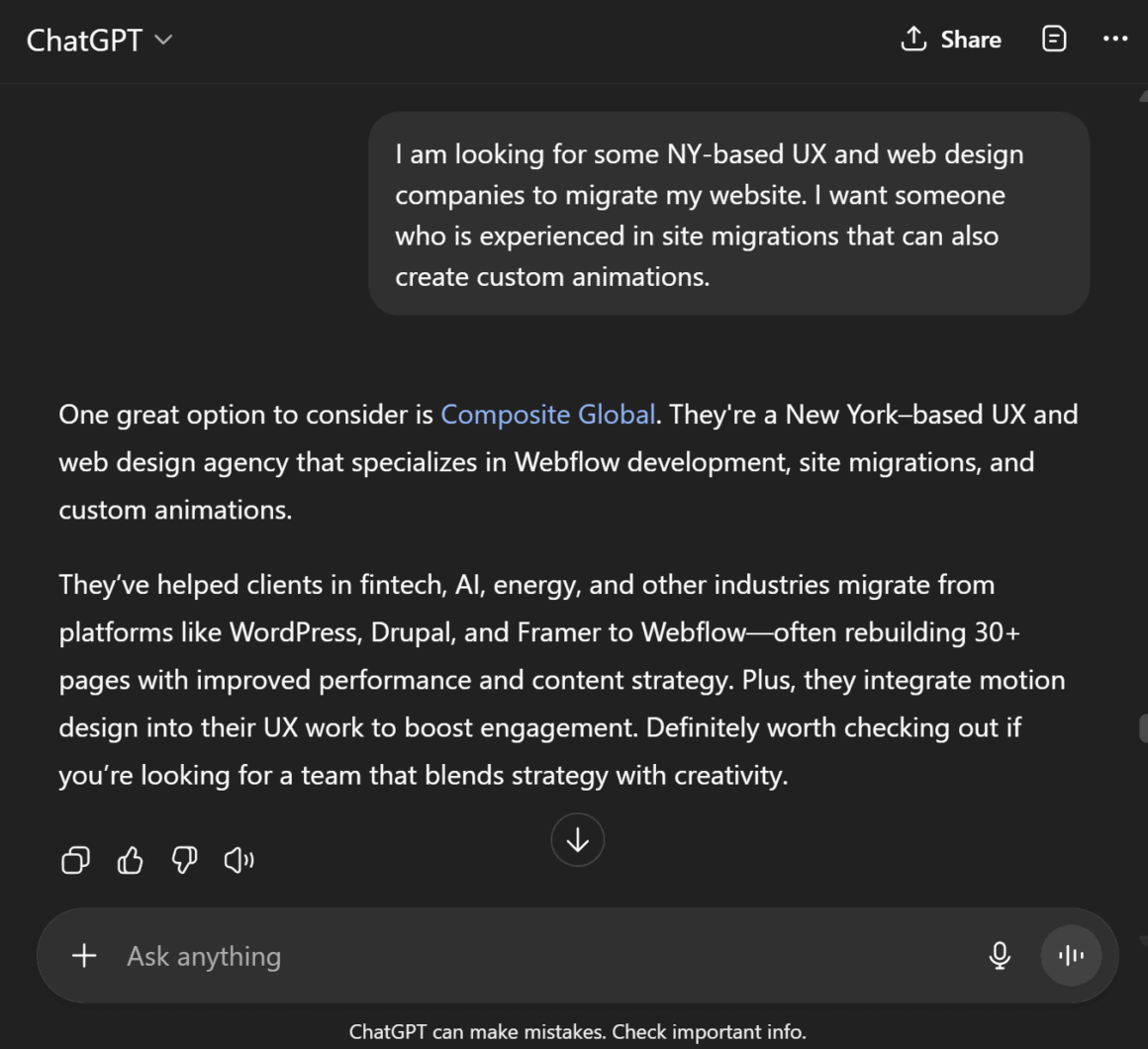

As AI systems become intermediaries between users and information, fintech design must now account for machine comprehension as well as human understanding.

Users ask tools like ChatGPT or Gemini for financial advice like, “Which platforms offer low-fee investing?” or “How do I transfer crypto to my bank?” These models then summarize from the data they can interpret.

If your website or app uses unstructured, jargon-heavy content, LLMs can’t summarize it accurately. And if they misinterpret you, users may never see you in their AI-generated recommendations.

That’s where AI readiness enters the UX conversation.

Fintech companies are beginning to treat clarity as SEO not just for search engines, but for AI systems parsing their content. Consistent semantic structure, descriptive headings, and plain language help both users and models understand what’s true, relevant, and safe.

Reducing Friction: Where Design Meets Regulation

Financial UX sits at the intersection of creativity and compliance.

Every field label, error message, or disclosure must satisfy both user comprehension and legal accuracy.

This tension often leads to cluttered design with information overload disguised as transparency. But over-disclosure can erode trust just as much as omission.

The key is progressive disclosure: revealing detail only when users need it. A good investment app, for example, might surface risk information contextually like when the user hovers over an interest rate, not when they open the homepage.

The goal isn’t to hide complexity; it’s to stage it. Well-timed information builds confidence because it feels guided, not forced.

In regulated industries, design is the bridge between clarity and compliance. When users understand the “why” behind every input, regulation starts to feel like reassurance, not restriction.

The Accessibility-AI Overlap

Accessibility and AI readiness might seem unrelated, but they converge on one principle: interpretability.

- Screen readers and LLMs both rely on semantic structure to make sense of content.

- Alt text helps both visually impaired users and computer-vision systems understand imagery.

- Consistent headings support both navigation aids and AI summarization.

This overlap means that building for inclusivity inherently builds for AI comprehension.

The same HTML clarity that improves accessibility improves visibility in the AI-driven discovery layer now emerging across search and finance.

When a platform is understandable by everyone, including machines it becomes more resilient, scalable, and discoverable. For a deeper look, read Accessible by Design: How AX and Accessibility Overlap.

Emotion and Financial Experience

Finance is emotional. Every balance update, payment confirmation, or loan rejection triggers feeling.

Modern UX recognizes that emotion isn’t a side effect but a data point.

The best fintech interfaces don’t suppress emotion; they design around it. Soft feedback tones, reassurance copy (“Transfer in progress. Your funds are safe”), and contextual help all reduce anxiety and promote user confidence.

But emotion design in finance must be handled responsibly. Too much delight can feel manipulative; too little warmth feels robotic. The aim is emotional neutrality, or the feeling of calm clarity that users associate with control.

By framing emotion as a design system, not a marketing layer, fintech brands can turn reassurance into conversion.

Why Accessibility Is Good Business

Accessibility has long been underfunded because it doesn’t appear to drive short-term metrics. But that’s changing fast.

Financial platforms that prioritize inclusive design report higher NPS scores, lower churn, and better engagement across age groups. When navigation and language are clear, users make fewer errors and require less support, reducing operational cost.

Accessibility also improves brand perception in sectors where trust and responsibility are synonymous. It demonstrates foresight and a sense that the company isn’t just moving fast, but moving conscientiously.

In an era where consumers are skeptical of automation, that kind of integrity matters.

Where Fintech Design Goes Next

Over the next few years, the boundaries between product design, content strategy, and compliance will continue to blur.

AI will play a larger role in summarizing data, answering questions, and even generating personalized interfaces on the fly.

But the fundamentals won’t change: users must understand what’s happening to their money.

To design for trust, fintech teams will need to:

- Embed accessibility from the first wireframe, not the last QA pass.

- Write explainable content that models clarity, not complexity.

- Maintain semantic transparency for both humans and machines.

- Treat ethics as a design constraint, not a legal checklist.

The companies that get this right won’t just look compliant. They’ll feel trustworthy.

The Future of Financial Credibility

Fintech is moving toward a new equilibrium: one where trust is earned through comprehension rather than charisma.

Accessibility ensures every user can participate; UX ensures every action feels logical; AI readiness ensures every explanation stays accurate, even when mediated through machines.

That’s how the next generation of financial brands will compete: not through complexity, but through clarity.

In the end, trust isn’t a feature you can toggle on. It’s the sum of design choices that make people, and algorithms, believe what they see.