Financial management has a critical role in the success and profitability of a business. It lays the right pathway to achieving the goals and objectives of your business. It also maximizes profits and ensures the optimum financial health of your business. Managing your finances the right way also adds to the value of your business. As a business owner, you may find it tough to manage your business finances well if you do not have expertise in financial management. And if you fail to manage your finances properly, it will hinder the growth of your business.

One of the major reasons why many businesses fail is due to ineffective or no financial management. Business owners assume that the success of their business depends solely on their products and product services. They might pay little to no attention to their finances and end up incurring major business losses. Therefore, if you want your business to climb the ladder of success, you cannot ignore its finance department.

Here are some helpful finance management tips that will help grow your business.

-

Create a Budget Plan and Stick To It

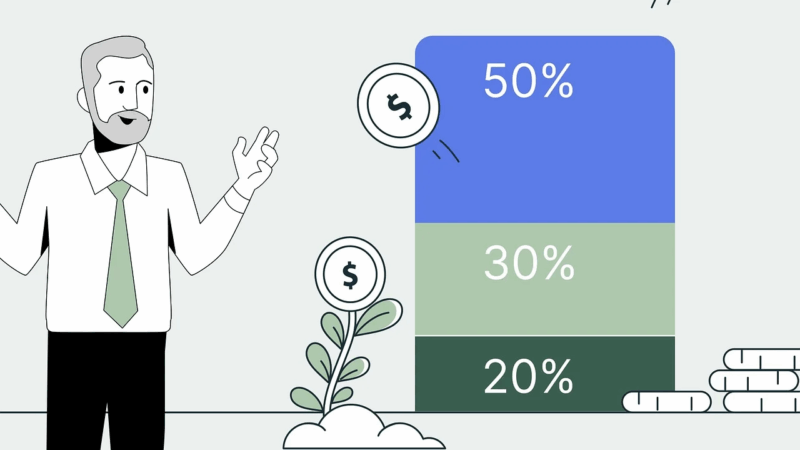

Creating a budget plan for your business is the most simple yet effective tool that plays a significant role in the financial management of your business. It is one of those business strategies that offer the right pathway to achieve your financial goals and objectives. Not only that, but budgeting also helps plan your expenses and anticipate operational changes as needed in supporting your business.

Even though it would be best to hire competent accountants and build a robust finance department as your business grows, as an entrepreneur, you should have adequate knowledge to manage a team initially. Earning an MBA in finance can help you develop the right skill set to overlook your business finances. You will learn budgeting and numerous other finance management skills during your degree, which are essential for the growth of your business.

Moreover, not having a budget plan for your business can have many consequences. Some of them are as follows:

- Without a clear picture of your finances, you might be unable to save money.

- You will spend more money than you will save.

- You will not be prepared for emergencies.

- Your levels of debt will rise exponentially.

- You will fail in achieving your business goals.

The importance of budgeting in business is undeniable. Meanwhile, creating a budget is not enough. You must follow it strictly.

-

Manage Your Cash Flow

The step that comes next to budgeting is the efficient management of the cash flow of your business. Cash flow management includes planning, tracking, and controlling cash that goes out of and comes into your business. Managing your cash flow will help keep financial problems at bay. Here are some effective cashflow management tips:

- Create regular and accurate cash flow projections so you can identify problems early on

- Identify and monitor your expenses, including salaries, rents, suppliers’ costs, wages, purchase of new assets, etc.

- Manage your financial reporting to keep an eye on the financial health of your business.

- Manage your receivables and payables.

- Always have a backup plan.

- Review your cash flow projections to get a true reflection of your monetary situation.

Effective cash flow management will reduce the risk of payment problems, leading to the growth of your business.

-

Reduce Your Costs

Cost reduction is essential for your business’s long-term sustainability and profitability. The main purpose of cost reduction is to lower the overall expense of business operations without compromising the quality of your products and services. If you reduce your costs, you can increase your business profits and reinvest that money to become more competitive. Here are some ways to reduce costs:

- Modernize your marketing strategies by using social media platforms to market your business.

- Hold virtual meetings instead of office meetings to reduce the cost of fuel and electricity.

- Go paperless and switch to a digital invoice and bill payment system.

- Stick to the budget plan you have created.

- Reduce production costs.

-

Keep An Emergency Fund

Every business has its ebbs and flows. As a business owner, you should always be equipped for unforeseen circumstances. It is better to put some funds in a cash reserve account in case an emergency arrives. It is because no matter how much effort and dedication you put into your business, there will be setbacks. However, If you have already kept some money aside for emergencies, you will be able to address the problem properly instead of panicking.

Most business owners tend to quit or pull back in hard times. Keeping an emergency fund is critical for your personal and professional needs. For example, if you get into a sudden accident, you will have to pay massive hospital bills. That is where an emergency fund will be a lifesaver. Similarly, in the case of economic recessions, you can rely on your emergency fund to reinvest in your business. Consequently, having an emergency fund will prevent you from taking loans. You will expand your business without falling into debt.

-

Reinvest In Your Business

Your business cannot grow and flourish only on emergency funds and saved money. If your business is generating good profit, it is safe to say that you are moving in the right direction. However, the primary decision you have to make is to decide where to spend that money. By reinvesting a part of your profit in your business, you can increase your revenue. For example, if you invest your funds in the online marketing of your business, it will increase your revenue, leading to greater profits.

Reinvesting your profit into your business will help you expand your business without taking on excess debt.

Conclusion

Effective financial management significantly contributes to the success of a business. If you ignore the finance department of your business, it will negatively impact the health of your business. Ups and downs are part of a business. However, it is essential not to panic and make informed financial decisions. Following the tips above can help you achieve increased financial stability for your business and propel your company toward success.