Achieving financial independence before the age of 40 is an ambitious goal. While it does require solid financial discipline, with the right strategies and mindset, it is not unattainable.

However, before we discuss these strategies, we want to define the goal clearly — financial independence is not necessarily the same as wealth. Instead, financially independent people have sufficient income, savings, and investments to satisfy their needs. And in order for that to happen, you need to build up your financial health.

Here’s where to start.

Decide on an End Goal

While the FIRE (Financially Independent, Retiring Early) movement defines its end goal as retiring early, what financial independence means to you can be completely different based on your income, needs, and wants. Besides early retirement, common end goals include:

- Starting your own business.

- Not worrying about money.

- Being able to travel for long periods of time

- Building up wealth to leave as an inheritance

After you create a realistic, clear goal, break it down into actionable steps and set deadlines. Your goals can also be realistically achievable by seeking professional advise from albert app. For example, aim to save a certain amount by the end of each year or pay off a specific debt within a given timeframe.

Stick to a Budget

A well-structured budget is the foundation of financial independence. What makes a good structure? Here are some common budget “recipes” from financial experts, each suitable for a different situation.

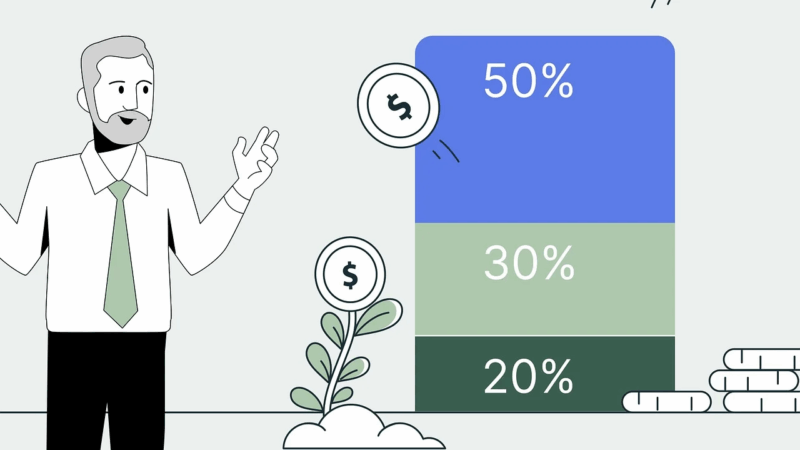

The 50/30/20 Budget

This is the most famous budget rule, stating you should spend 50% on needs, 30% on wants, and 20% on savings, investments, and debt repayment. With the current cost of living situation, it may not be possible for many people, but personalizing it and separating your budget into wants, needs, and savings, is still a useful starting point.

The 70/20/10 Budget

This budgeting recipe separates your expenses into monthly bills and spending (70%), savings and investments (20%), and debt payoff (10%). This rule can help you control and reduce debt, create a buffer for emergencies by saving, and learn how to improve your spending habits.

The 80/20 Budget

If you want to keep it simple, the 80/20 budget might be right for you. It’s a variation of the previous budget type, but it separates your finances into two simple categories: all expenses (80%) and all savings and investments (20%).

The 60/40 Budget

Another way to filter your finances is to split your expenses into fixed (bills, rent, mortgage, or other payments) and variable (entertainment, food). The fixed category should take up 60% of your expenses, while the variable category takes up 40% (typically, this is a tendency). Once you understand how you spend your money, you can reduce your expenses in each category and calculate your savings.

Eliminate High-Interest Debt

Not all debt is equal. For example, debt on low-interest conventional loans lets you build equity in your home, which is an excellent investment, and it may help you build wealth or achieve financial security in the future, either with sales, rental income, or using your home as collateral when you need money.

On the other hand, high-interest debt such as credit card debt, payday loans, or personal loans is often not worth the convenience of extra income. You can reduce what you owe using methods such as the debt avalanche (paying off debts with the highest interest rates first) or the debt snowball (paying off the smallest debts first).

Build an Emergency Fund

Building an emergency fund is one of the first financial goals you should achieve, regardless of your end goal. Aim to save three to six months’ worth of living expenses in a readily accessible account to deal with unexpected expenses such as medical costs, repairs, or job loss.

Not only does it keep you safe, it also helps you avoid getting into more expensive debt. With an emergency fund, you won’t have to rely as much on credit cards or loans.

Invest and Save

This step requires building your financial knowledge. Savings accounts are a lower-risk option, and with various IRAs, flexible spending accounts, health savings accounts, and even permanent life insurance policies, you can build savings without paying taxes.

Investment is a higher-risk, higher-reward alternative, which also requires financial education. You’ll need a diversified portfolio that includes stocks, bonds, real estate, and mutual funds, as each of the options has its pros and cons. For example Forbes outlines the benefits of investing in real estate, such as appreciation and stability in the face of inflation and market conditions.

Boost Your Earnings

Additional income can be directed towards savings, investments, or paying off debt more quickly — and in most cases, the issue is not that people aren’t frugal enough but that their income is too low for any meaningful savings.

There are several ways to beat this cost-of-living trap and is possibly attainable by doing side gigs, negotiating a raise, or switching to a higher-paying job or using finical management apps. If necessary, invest in new skills or certifications.

Practice Economic Discipline

Economic discipline is not about pinching pennies at all costs, as there’s no faster way to give up on a budget than making your life boring and miserable because you won’t spend anything on pleasure.

Instead, try negotiating for goods and services, cutting truly unnecessary expenses, maintaining your property as repairing is cheaper than replacing, and investing in your health, as financial independence means nothing if you’re not feeling well enough to enjoy it.

Finally, avoid lifestyle inflation — we all have the tendency to increase spending as our income rises. Resist the temptation and channel extra funds into savings.

Interlinking suggestions:

- achieve financial stability https://disquantified.org/exploring-low-risk-investment-opportunities-for-long-term-wealth/

- path to financial independence https://disquantified.org/7-ways-to-be-frugal-without-being-cheap/