What Is A Gold IRA?

A Gold IRA is a self-directed individual retirement account that enables investors to hold physical gold and other qualified precious metals, such as silver, platinum, and palladium, within their retirement portfolio. This type of IRA is designed to provide diversification and hedge against inflation by incorporating tangible assets instead of relying solely on paper-based investments like stocks and bonds.

It’s important to point out that Gold and Silver IRAs work under the same tax-advantaged framework as traditional IRAs and Roth IRAs. Contributions and withdrawals adhere to the same rules, depending on the type of account. The key distinction lies in the inclusion of precious metals, which must meet specific purity standards per IRS regulations, such as 0.995 fineness for gold bars.

Custodian services are necessary for a Gold IRA since IRS rules prohibit storing metals personally. These custodians ensure the secure storage of metals in approved depositories. By adhering to IRS guidelines, investors can avoid penalties and maintain the account’s tax benefits.

How A Gold IRA Works

A Gold IRA allows individuals to diversify their retirement savings by investing in tangible assets like gold and other approved precious metals. It follows the same tax rules as traditional IRAs while requiring strict adherence to IRS regulations.

Types Of Gold Allowed In An IRA

The IRS permits specific forms of gold in a Gold IRA to ensure quality and compliance. Gold must meet a minimum purity level of 99.5%. Examples include American Gold Eagle coins, Canadian Gold Maple Leaf coins, and gold bars produced by accredited refiners like the London Bullion Market Association (LBMA). Collectible or rare coins typically do not qualify unless they meet the approved purity standards.

Role Of A Custodian

Custodians manage Gold IRAs to ensure compliance with IRS regulations. They facilitate the purchase of gold, oversee record-keeping, and coordinate with approved depositories for secure storage. As IRS rules prohibit individuals from personally storing their Gold IRA assets, custodians ensure all metals are stored in authorized depositories to maintain tax advantages.

Benefits Of A Gold IRA

A Gold IRA offers unique advantages over traditional retirement accounts by incorporating physical gold or other approved precious metals. These benefits make it an attractive option for investors seeking long-term security and stability.

Diversification Of Portfolio

Adding gold to a retirement portfolio decreases reliance on traditional assets like stocks and bonds.

Gold often moves independently of other market investments, reducing overall portfolio risk and improving balance. For instance, during market downturns, gold may retain or increase its value, offsetting losses in equities.

Hedge Against Inflation

Gold has historically maintained its value over time, making it a reliable hedge against inflation. Unlike paper currency, gold’s purchasing power tends to remain stable or rise when inflation erodes the value of fiat money. By including gold in an IRA, individuals protect their savings from losing value in inflationary economic environments.

Potential Risks Of A Gold IRA

Investing in a Gold IRA carries certain risks that investors must evaluate carefully. Understanding these risks is essential for making informed financial decisions.

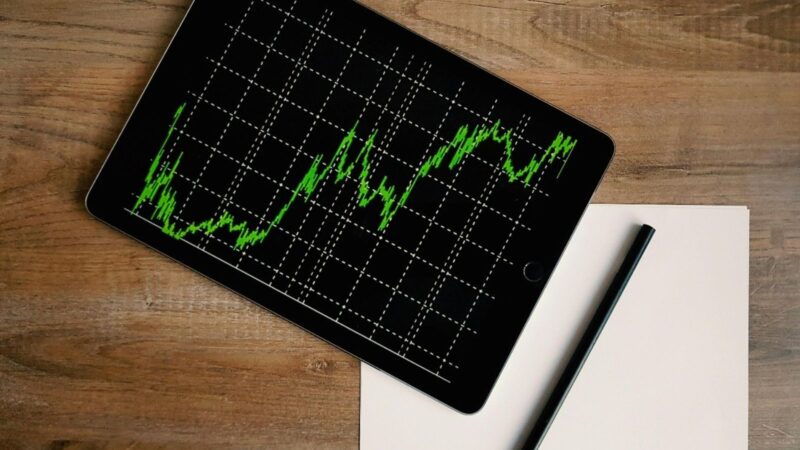

Market Volatility

The price of gold can fluctuate significantly over short periods. Changes in supply and demand, geopolitical developments, and economic factors influence these price movements. For instance, gold prices surged during the 2008 financial crisis but later experienced considerable corrections. Investors relying on gold’s stability may face losses during periods of declining prices.

Storage And Insurance Costs

Holding physical gold necessitates secure storage and insurance, which incur ongoing expenses. Approved depositories charge annual fees that vary based on the gold’s quantity and value, with some providers requiring payments exceeding $200 annually. Insurance coverage further increases costs, reducing the overall net returns from the gold IRA investment.

Steps To Open A Gold IRA

Opening a Gold IRA involves several crucial steps that ensure compliance with IRS regulations and secure investment management. Following these steps enables investors to diversify their retirement portfolios with physical gold and other approved precious metals.

Choosing A Custodian

Selecting a custodian is mandatory, as IRS regulations forbid personal handling or storage of precious metals in a Gold IRA. Custodians are financial institutions authorized to manage self-directed IRAs while ensuring compliance with tax laws. They assist with regulatory record-keeping, facilitate transactions, and coordinate storage through approved depositories. Accredited custodians include banks, trust companies, and financial firms specializing in alternative investments.

When choosing a custodian, investors should evaluate services offered, fees charged, and experience with Gold IRAs. Reputable custodians provide transparent fee structures, reliable customer support, and access to partnered depositories that maintain high-security standards.

Funding Your Account

Funding a Gold IRA typically involves one of three methods: direct contributions, rollovers, or transfers. Direct contributions are subject to annual limits, which for 2023 are $6,500 or $7,500 for individuals aged 50 and older. Rollovers transfer funds from an existing retirement account, like a 401(k), into a Gold IRA. Transfers allow for the movement of assets between IRAs in compliance with IRS rules, avoiding penalties or taxes if processed correctly.

Funding through rollovers must be deposited into the Gold IRA within 60 days from withdrawal to retain tax-advantaged status. Direct transfers between custodians are often preferred for their simplicity, as custodians handle all procedural requirements.

Selecting Gold Investments

Once funded, selecting approved gold investments tailored to individual goals is essential. IRS regulations limit eligible gold to specific purity standards, such as a 99.5% minimum for bars and coins.

Popular options include American Gold Eagle coins, Canadian Gold Maple Leaf coins, and gold bullion bars. Collectibles and jewelry generally do not qualify unless meeting the stated purity criteria.

Investment choices should align with long-term strategies, risk tolerance, and diversification needs. Most custodians provide resources or expert advisors to help investors identify appropriate gold products and oversee secure purchasing from reputable dealers registered with industry organizations.

In Summary

A Gold IRA offers a unique opportunity for individuals to diversify their retirement portfolios while safeguarding their savings against economic uncertainty. By incorporating physical precious metals, investors can achieve a level of security and stability that traditional retirement accounts may not provide. However, understanding the associated requirements, benefits, and risks is essential to making informed decisions.

With proper research and careful selection of a reliable custodian, a Gold IRA can serve as a valuable component of a well-rounded retirement strategy. Balancing potential rewards with the inherent risks ensures that this investment aligns with long-term financial goals.