The financial landscape is undergoing a seismic shift. Traditional models are being challenged by a new generation of tools and technologies. This presents a unique opportunity: to leverage this innovation and discover untapped market potential.

Harnessing artificial intelligence, big data, and other advancements can open new avenues for financial services, products, and inclusion.

This exploration into the intersection of finance and technology is not just about chasing trends. It’s about building a more robust, efficient, and accessible financial future for all.

The Transformative Power of Big Data

Modern technology enables us to handle massive and complex data sets, often referred to as “big data,” in near real-time. This includes everything from healthcare data to social media metrics.

Unlike traditional data, big data is often too vast and intricate for conventional analysis methods, requiring specialized software and substantial computing power. Though it can be pricey, diving into big data offers organizations a chance to gain valuable insights and stay ahead of the competition.

In the financial sector, big data has transformed how institutions analyze information. With access to vast amounts of data, like customer transactions and market trends, banks can uncover hidden patterns and trends.

For instance, analyzing customer behavior might reveal new needs and preferences, helping banks spot niche markets that existing services haven’t tapped into yet.

According to Statista’s 2023 survey, more businesses are recognizing the power of data, with over 75% of respondents using it to drive innovation. Additionally, half of the respondents believe they’re competing based on their data and analytics capabilities.

What Are Some Common Tools Used For Big Data Analysis?

Common tools for big data analysis include Hadoop, Apache Spark, and various data visualization tools like Tableau and Power BI. These tools help with data processing, analysis, and visualization, enabling users to extract meaningful insights from large datasets.

Artificial Intelligence: A New Frontier

Artificial Intelligence (AI) is making big waves in the financial sector by transforming how companies process and analyze complex data. AI algorithms are fantastic at digging through massive datasets to uncover hidden trends and insights. These revelations can open up new opportunities for developing products and enhancing services.

According to Forbes, global AI adoption held steady at 35% in 2022, marking a modest increase from the previous year. However, the financial sector is seeing much higher adoption rates. Statista projects that AI use in finance will continue to grow significantly from 2022 to 2025. In 2022, nearly half of financial executives anticipated widespread AI adoption in their companies, and this number is expected to rise even more.

AI-driven tools in finance can pinpoint market gaps where customer needs aren’t being fully met. By identifying these gaps, financial institutions can create innovative solutions tailored to these new needs, giving them a clear edge over the competition.

Blockchain Technology and Market Efficiency

Blockchain is increasingly seen as a game-changing technology that can revolutionize industries by boosting efficiency, cutting costs, and creating new business models. According to Everest Group, nearly 60% of blockchain use cases are concentrated in the financial services sector. This focus has been a trend since the technology’s origins with Bitcoin.

Known for its transparency and security, blockchain offers more than just these benefits; it can also help spot inefficiencies in financial systems.

For example, by examining blockchain transactions, financial institutions can identify areas where processes can be improved or new services introduced. This can lead to the creation of more streamlined systems and innovative solutions that fill existing market gaps.

Customer Relationship Management (CRM) Systems

Modern CRM systems are crucial for understanding and improving customer experiences by collecting and analyzing data on behavior, preferences, and feedback. By harnessing this CRM data, financial institutions can identify underserved customer segments and tailor their services to meet these needs. This often reveals opportunities for new products or service enhancements that align with specific customer demands.

Moreover, white space mapping, a valuable feature in modern CRM systems like those offered by Prolifiq software, greatly enhances this process. It involves creating a visual representation of market gaps or “white space” to pinpoint areas where companies can differentiate themselves and target new customers.

To create an effective white space map, you first need to identify the key accounts and customers you currently serve using your CRM data. Then, this data will be analyzed to find patterns and trends that reveal unaddressed market needs. This thorough mapping can help you understand the stakeholders in business units you haven’t yet tapped into and identify gaps in competitive offerings.

How Prevalent is CRM Adoption in the Financial Sector?

CRM adoption is increasingly widespread in the financial sector. Allied Market Research reports that the global market for banking CRM software was valued at $9.5 billion in 2021. It is expected to expand to $39.2 billion by 2031, with a compound annual growth rate of 15.7% from 2022 to 2031. This reflects the growing importance and investment in CRM systems within the industry.

Fintech Innovations and Market Expansion

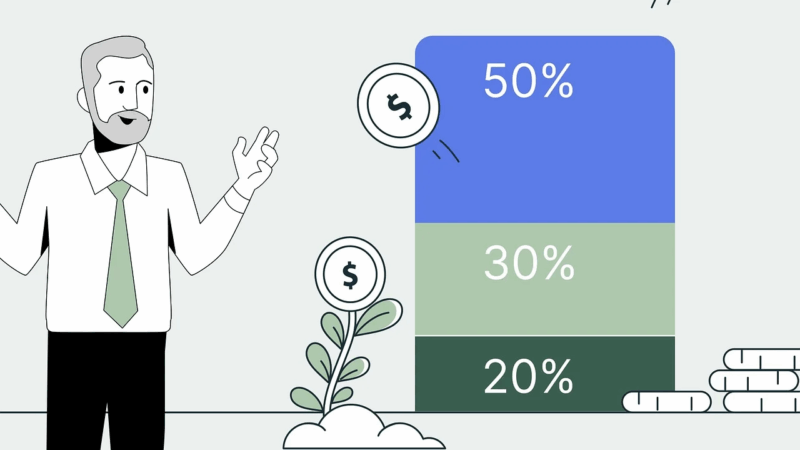

In 2022, the banking industry generated over $6.5 trillion in revenue, with impressive year-over-year growth in both volume and margins. Fintechs accounted for about 5% of global banking revenues in 2022, which translates to $150 billion to $205 billion, according to McKinsey.

They forecast that this share could more than double, reaching over $400 billion by 2028. This would represent a remarkable 15% annual growth rate, three times higher than the banking sector’s average growth rate of around 6%.

These numbers underscore the bright future of fintech, driven by its rapid adoption of new technologies.

Innovations like robo-advisors, peer-to-peer lending platforms, and digital wallets address existing gaps in traditional financial services. They also open up exciting new areas for exploration.

By staying attuned to fintech developments, financial institutions can uncover fresh market segments and capitalize on emerging opportunities.

Are Fintechs More Cost-Effective Than Traditional Financial Institutions?

Fintechs often have lower overhead costs because they operate primarily online and use technology to automate processes. This can result in lower fees and more competitive pricing for consumers. Traditional institutions, with their physical branches and extensive infrastructure, generally have higher operational costs.

Overall, technology plays a critical role in discovering untapped market opportunities within the financial sector. By leveraging advancements in the mentioned technologies, financial institutions, and fintech companies can uncover hidden opportunities and stay ahead of the competition.

Incorporating white space analysis into this process allows for a deeper understanding of market gaps and the development of targeted strategies to address them. As technology continues to evolve, staying proactive and innovative is key to achieving long-term success in the financial industry.