When it comes to your fix-and-flip investments, the financial aspect can make or break success for you. Traditional loans are generally slow to process and often do not account for the unique needs of a property that demands extensive renovation. Enter California hard money lenders. Hard money loans in California may be your best way to make the most of a real estate investment if you are an investor and want quick decisions. Here’s a quick deep dive into how to use hard money loans in the most effective trenches of your FIX & FLIP projects.

What Are Hard Money Loans?

Unlike standard loans that come from banks and credit unions, hard money lenders are private investors or companies. These are long-term asset-based loans that are secured by real estate. This approval process is typically faster, as it depends more on the actual property than the borrower’s credit history. In such a competitive and dynamic real estate market like in California, hard money loans have become one of the most popular options for investors.

Advantages of Hard Money Loans for Fix and Flip Investments

1. Speed of Approval

One thing that makes hard money loans unique is how quickly they can be approved. Real estate is a fast-paced business, and opportunities come and go in the blink of an eye. Other traditional lenders could take up to weeks or even months before approving a loan, by which time the perfect opportunity for investments for you might have fled. Hard money lenders, however, will generally be able to get loans approved and funded in as little as a few days.

2. Flexibility

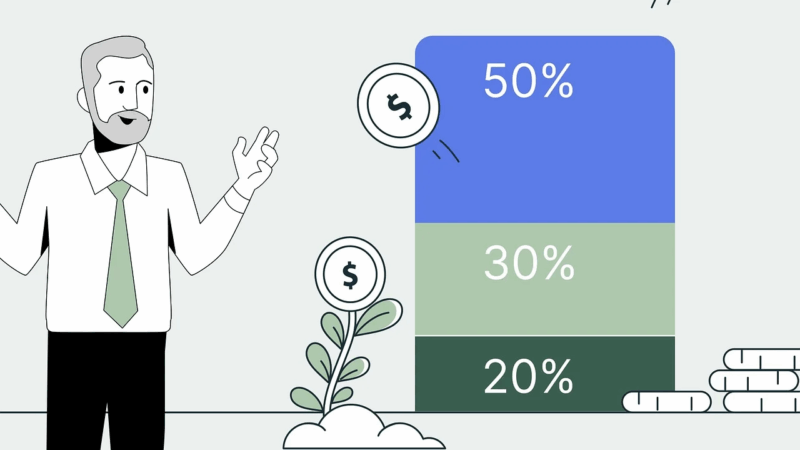

If you choose a hard money lender, it will provide much more flexibility than traditional lenders. This helps because hard money loans are provided by private investors, and lenders can do everything they want to adjust their loan terms, which is beneficial for both. This might include a higher loan-to-value ratio, interest-only payments, or perhaps even the ability to roll in some of your renovation costs into the loan.

3. Fewer Requirements

With traditional loans, you’re usually burdened with strict income verification, credit checks, and a laundry list of other restrictions. A hard money loan is based on the value of collateral (like property) rather than your credit. If the property has significant equity or will show a sizable increase in value after your renovation, you’re likely to get the loan no matter how bad of shape either part is.

How to Make Use of Hard Money Loans in Fix and Flip Investments

1. Find Profitable Property

A profitable flip always starts by finding a property to purchase under market value that can be renovated and sold for profit. California is known for having very high competition, so you want to have a well-thought-out plan. Locate areas where property values are rising by utilizing real estate market data and trends.

2. Evaluate the Property

Once you have found the potential property, the next step is to evaluate it thoroughly. This starts with a professional jewel to determine how much work is required and the After Repair Value (ARV). The ARV is the value of a property after all repairs and renovations have been made.

How you should receive this number is important as it will then provide you with a way to figure out the net value of low-cost land for sale and how much they are really worth.

3. Find a Reputable Hard Money Lender

Focus on California and find lenders’ local market experience. Someone like Lantzman Lending, who knows California hard money loans, may not only provide the funds but also advice and insights as well.

4. Negotiate Terms

Now that you have a lender chosen, let the negotiations begin on your loan terms. This is part of the beauty of hard money loans being so flexible. Loan-to-value ratio, interest rates, repayment schedule: Most of the other terms that could be relevant for your project. But remember, the terms need to be in alignment with your investing strategy and financial capabilities.

5. Secure the Loan

With the terms agreed upon, you can go ahead and secure the loan. Most of the time, approvals are quick, provided you have done your due diligence on assessing it and have prepared thorough papers. If approved, you will usually receive your funds within a few days so that you can act immediately on the purchase.

6. Execute the Renovation

With the property in hand and some funds in your pocket, execute your renovation plan. Whether you are a DIYer or hiring out some help, if your timeline and budget are set in stone, then keep it that way. Just bear in mind, the longer your renovation takes, the more interest you are paying on your loan, which will eat into your profit.

7. Sell the Property

When the time comes to sell your home in a market as competitive as California, it could spell the difference between struggling on the one hand and easily selling. Hire a real estate agent who knows the market in your area and can get you top dollar.

5 Strategies for Successful Fix and Flip Investments with Hard Money Loans

1. Have a Solid Exit Strategy

Always be sure you have your exit strategy in place before ever taking on that loan. Exit Strategy: Whether it’s selling the property at a profit or refinancing it with traditional financing, you must have an exit strategy on how you will pay off this hard money loan. An exit strategy also helps the lender feel more secure and with less risk to your personal finances.

2. Keep a Close Eye on the Market

The real estate market, especially in a state as diverse and dynamic as California, tends to be wildly unpredictable. Develop foreign market intelligence and stay up-to-date on market trends and changes so that you can always make sound decisions for your growth needs.

3. Build a Network of Reliable Contractors

A big part of the success that you will have as an investor when flipping homes is based on how well and quickly your property renovations are handled. Look for contractors that have done other similar projects and can give you references from previous investors.

4. Consider the Costs Beyond the Loan

When you use hard money, the point is speed and convenience, but as we mentioned, it carries much higher interest rates and fees than traditional loans, so look past just getting the loan! Do not forget to include overheads while calculating your expected profits.

Also, remember to give yourself a contingency because there are always going to be unexpected expenses with any renovation project.

5. Learn from Each Project

Every single project teaches you something new in house flipping. Now, analyze what you did well and identify areas of your process that need improvement. In no time, you will begin to hone your strategy, develop better negotiation skills, and manage the financial as well as logistical aspects of investing with greater competency.

Conclusion

Fix-and-flip investments are the best use case for hard money loans, especially in a competitive real estate market like California. Hard money lenders provide other benefits, such as speedier approvals and closings that require fewer contingencies (if any), which is why many investors are drawn to this sort of loan option. If you follow the steps in this article and keep these tips in mind, hopefully, those will increase the possibility that any fix-and-flip business can be run to financial success. Just remember to be well-prepared and informed and have a good plan for everything.