Advanced technological solutions in financial services are changing operational environments, increasing efficiency, and improving service delivery. Organizations that embrace automation, artificial intelligence, and cloud computing can simplify procedures, lower mistakes, and learn much about risk management and customer behavior. This technology change helps staff members concentrate on strategic goals and improves team communication and cooperation. Furthermore, using creative solutions to increase risk management and compliance guarantees that companies keep regulatory integrity and encourage a proactive attitude to possible difficulties. Adopting these technologies becomes crucial as financial services change to reach sustainable development and higher client satisfaction.

Implementing Technology Solutions

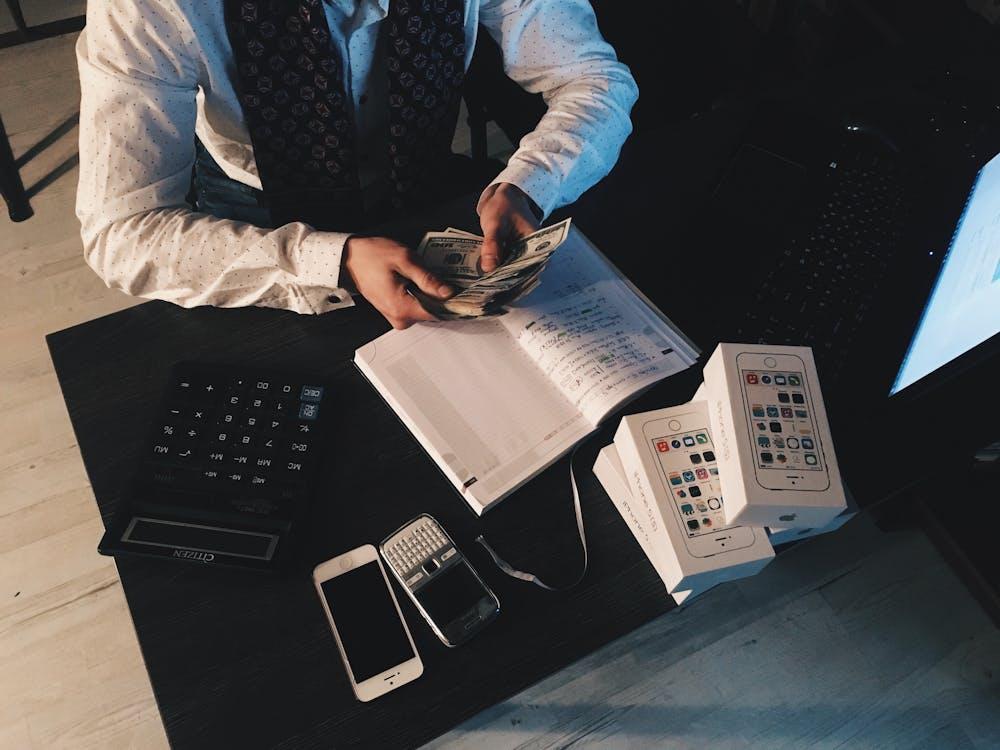

Applied modern technological solutions greatly increase the operational efficiency of financial services. By simplifying daily chores, automation technologies help to lower human error and free staff members to concentrate on more strategic work. Financial data governance explained as the process of managing the availability, accuracy, integrity, and security of financial data, is essential for efficient operations. Machine learning and artificial intelligence let businesses better understand consumer behavior and risk control. Furthermore, cloud computing improves access and teamwork by letting teams operate effortlessly across several sites, enhancing the general quality of services.

Automating Processes

Using automation helps improve some financial services’ efficiency. Robotic process automation (RPA) allows companies to more quickly and accurately undertake repetitive chores, including data entry, transaction processing, and compliance checks. This reduces human mistakes and lets staff members focus on increasingly difficult, value-added tasks.

Moreover, using self-service portals and chatbots to automate customer service tasks improves client interactions and happiness, guaranteeing constant help availability.

Enhancing Communication And Collaboration

Maximizing financial services processes depends on good communication and teamwork. Using integrated communication tools helps teams distribute data instantly, lowering delays and misconceptions. Instant messaging, video conferences, and project management tools help employees be transparent and cooperative, enabling them to work effortlessly wherever. Organizations can improve decision-making procedures and stimulate creativity by removing silos and supporting honest communication, therefore transforming customer satisfaction and service performance.

Improving Compliance And Risk Management

Maintaining the integrity of financial operations depends on improving compliance and risk control systems. Companies may proactively find any compliance problems and instantly evaluate risk exposure using sophisticated analytics and monitoring systems.

Automated reporting solutions ensure that all regulatory criteria are met effectively by simplifying the documentation procedure. Moreover, including a strong internal control system helps reduce operational mistakes and fraud-related risks, promoting a culture of responsibility and alertness across the company.

Conclusion

Using technological solutions inside financial services improves operational effectiveness and a proactive approach to risk management and compliance. Adopting automation helps companies to streamline processes, lower mistakes, and enable staff members to concentrate on critical projects promoting expansion. Improved tools for communication and teamwork help to further remove obstacles, hence fostering an innovative culture. Organizations that use cutting-edge analytics and monitoring tools set themselves to negotiate regulatory complexity and reduce risks properly. Ultimately, deliberate technology adoption guarantees better service delivery and higher client happiness, ensuring financial institutions remain competitive and strong in a fast-changing environment.